theme: insurance

theme: insurance

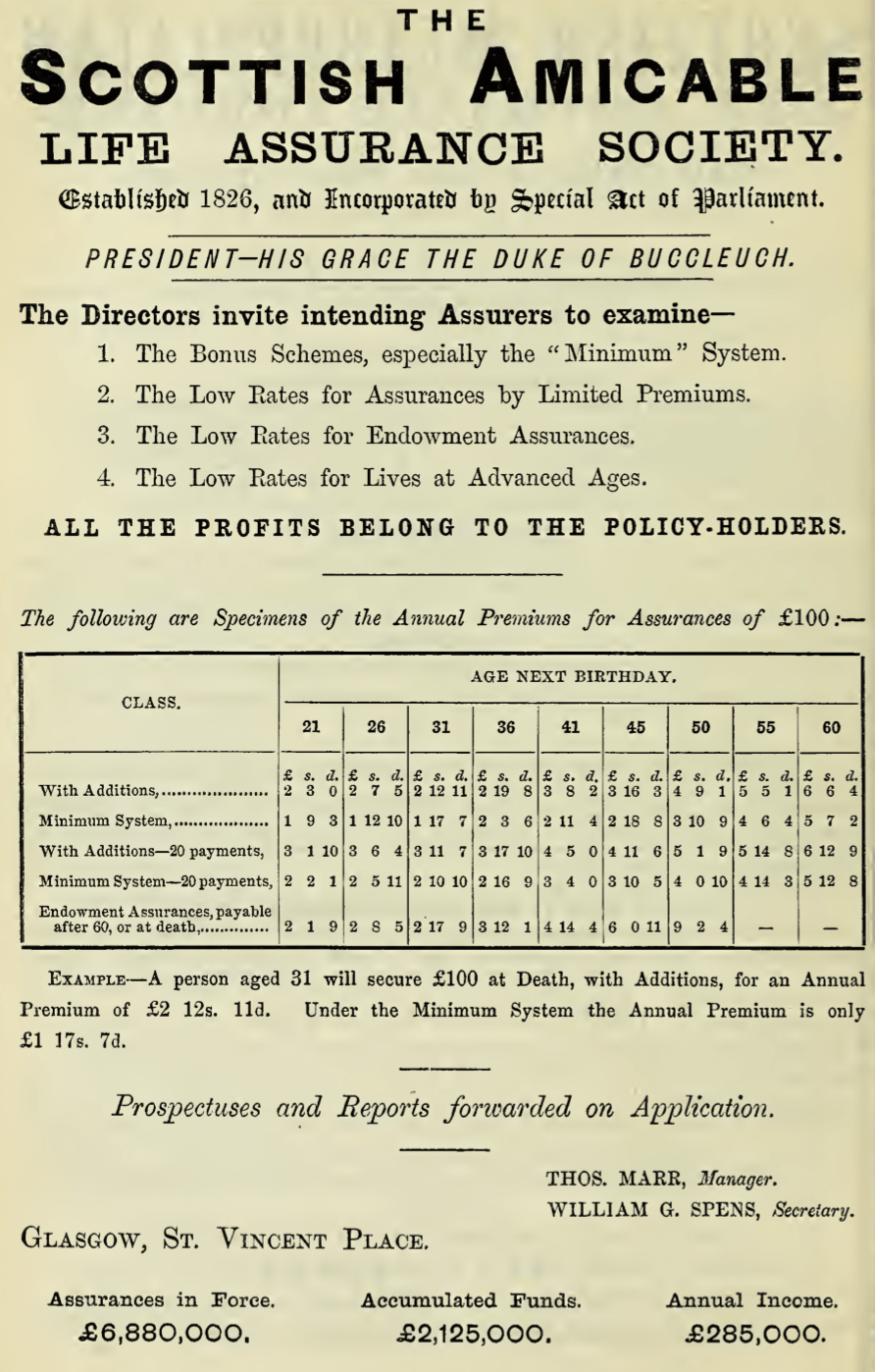

Scottish Amicable

1880

Life assurance as a system is based on the fact that human life, proverbially the most uncertain of all things, yet follows, in the aggregate, a fixed law . . . while we cannot tell how long any one man may live, we are enabled, by the study of mortality, to predict with singular exactness how many men out of any large body will die in each year until all the lives are extinct. [Scottish Amicable, prospectus 1876]

(McFall, 2011, p.670)By the first decades of the nineteenth century there was a relationship between insurance company practice and statistical knowledge. Companies did use mortality statistics to price their premiums and they did use probabilistic and actuarial calculations to forecast their liabilities. But statistics did not, perhaps could not, offer the kind of financial guarantees that company publicity implicitly promised. Companies wilfully overstated the certainties promised by statistics and probabilistic reasoning and glossed over the real and salient distinction between the populations they insured and the population from which the mortality tables they used were drawn.

(McFall, 2011)theme: insurance

theme: insurance