theme: technical_analysis

theme: technical_analysis

Foundations of Technical Analysis

2000

One of the greatest gulfs between academic finance and industry practice is the separation that exists between technical analysts and their academic critics. In contrast to fundamental analysis, which was quick to be adopted by the scholars of modern quantitative finance, technical analysis has been an orphan from the very start. It has been argued that the difference between fundamental analysis and technical analysis is not unlike the differ- ence between astronomy and astrology. Among some circles, technical analysis is known as "voodoo finance."

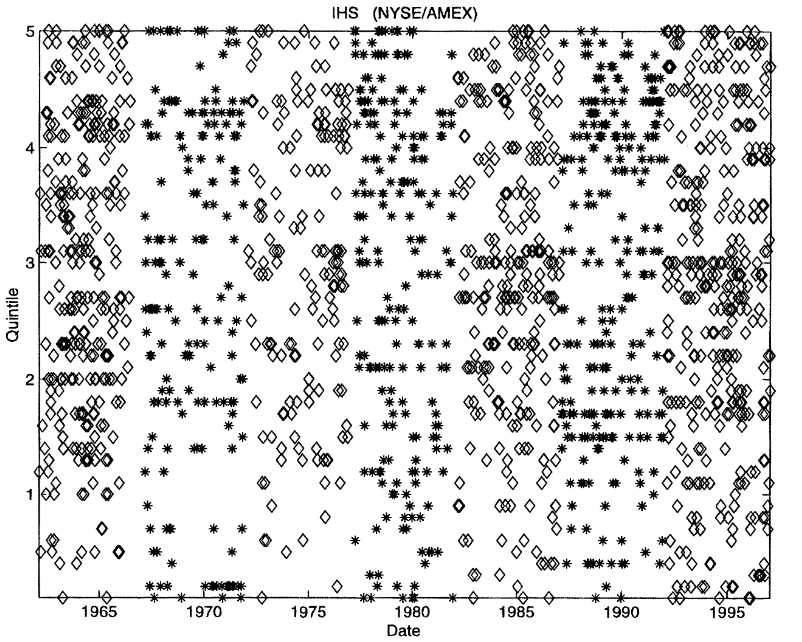

(Lo, Mamaysky and Wang, 2000, p.1705)In this paper, we hope to bridge this gulf between technical analysis and quantitative finance by developing a systematic and scientific approach to the practice of technical analysis and by employing the now-standard meth- ods of empirical analysis to gauge the efficacy of technical indicators over time and across securities.

(Lo, Mamaysky and Wang, 2000, p.1708)Lo, A. W., Mamaysky, H. and Wang, J. (2000) ‘Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation’, The journal of finance, 55(4), pp. 1705–1765. doi: 10.1111/0022-1082.00265. [link]

theme: technical_analysis

theme: technical_analysis